Medical Insurance

Quotes

Browse and buy affordable health insurance plans here. Compare FREE quotes from major medical insurance companies on our list!

Get Instant Quotes

Shop Online for affordable Medical Insurance. Individual & Family HMO, PPO or Major Medical plans. All Major Companies represented.

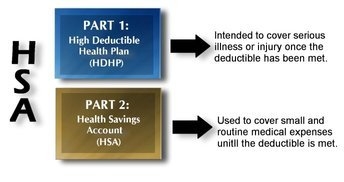

Understanding Health Savings Accounts – HSA's

HAS's are a great supplemental tool that can be used to enhance certain health insurance programs. Some of the advantages to an HSA are the fact that the balance and any subsequent earnings on the account are tax deferred and if you use any of that money for medical expenses it is tax-free. This allows for you to obtain a High Deductable Health Plan, or an HDHP, as you will be able to use your HSA to help pay your deductable. What this will accomplish is a lower monthly premium for you to pay. You can also continue to accumulate the money from year to year in your HSA and if you are retired it can actually be used to supplement your income after all medical expenses are paid.

HAS's are a great supplemental tool that can be used to enhance certain health insurance programs. Some of the advantages to an HSA are the fact that the balance and any subsequent earnings on the account are tax deferred and if you use any of that money for medical expenses it is tax-free. This allows for you to obtain a High Deductable Health Plan, or an HDHP, as you will be able to use your HSA to help pay your deductable. What this will accomplish is a lower monthly premium for you to pay. You can also continue to accumulate the money from year to year in your HSA and if you are retired it can actually be used to supplement your income after all medical expenses are paid.

In order for HSAs to work properly they must be paired with HSA-compatible health care plans. Virtually all of the insurance providers that there are will offer HSA-compatible plans. This is good news for you and means that you can take the cost savings offered by the HDHP in comparison to the traditional medical insurance policy and deposit the funds into an HSA. If you do not have an HSA you can open one at most banks or credit unions.

Once your HSA is established you can contribute up to $3,050 for individuals and up to $6,150 for your family per year. In many ways an HSA works like an IRA. Just as with an IRA you have until April 15th to make contributions for the previous year so long as your maximum has not been reached. For income tax purposes you are able to deduct the amount of money that you contribute to your HSA just as you would be able to with your IRA. The money that you deposit into the HSA and any interest are tax deferred and if used properly they can end up being tax free.

An example of acceptable tax free usage of your HSA funds is as follows. If you are going to get a test done that will cost a total of $1,000 and your deductable is $600, then you can use $600 from your HSA -so long as you have that much in the account- to pay the cost of the deductable and it will be a tax free event. If you have not maxed out your contribution to your HSA you can continue to build up the balance or wait until the following year to so if you have already maxed out the contributions.

While HSAs are wonderful to have they are not allowed to be obtained by everyone. Those who have good health insurance with low deductibles and 100 percent coverage on most tests and procedures will be prohibited from obtaining an HSA. Only those with an HDHP will be able to qualify for an HSA.

If you are offered health insurance through work it will all depend on the type of coverage you are offered when it comes down to whether you can have an HSA or not. If you employer offers good quality traditional coverage then you will most likely not be eligible get an HSA nor will you really need one. However, if your employer offers you ala-carte type insurance then you may decide to go with an HSA and HDHP plan if it is in your best interest.

A common mistake to make with HSAs is to think that they are the same as Flexible Savings Accounts, or FSAs. The two are not one and the same and there are a couple of big differences with them. First is with what is known as the ’plan year' for the FSAs. A plan year usually runs one calendar year and if the money in the FSA account is not used by the end of the plan year it is forfeited, unlike the HSAs that simply sees its funds forwarded. The other main difference is with the withdrawals. FSAs withdrawals have to be what are known as ’qualified' and are somewhat stricter than the rules and regulations in regards to the HSAs thus making it harder to keep your tax free status when making a withdrawal.

While not for everyone, HSAs can prove to be a literal life saver when funds are low and an accident or other medical emergency occurs. An HSA cannot only help you to save some money tax deferred, but it can also help to save the day and is a welcomed cushion for you to fall back on should you ever need it

Back To: Medical Guides